Smartphones Bounce Back

The Q4 smartphone market jumped 12.1% to reach 337 million units after a slump lasting eight quarters, says TrendForce. Despite this, 2023 units fell 2.1% to 1.166 billion.

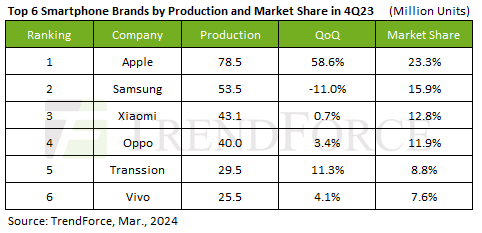

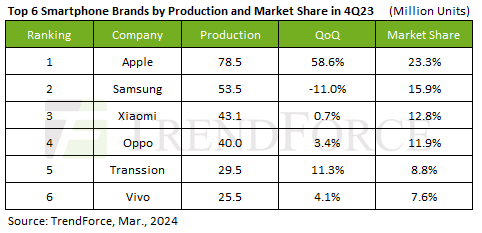

Apple grew Q4 production by 58.6% taking the lead with roughly 78.5 million units, a,though y-o-y production was down 4.2% at 223 million units at securing second place for 2023.

With Huawei’s resurgence, Apple is anticipated to encounter heightened competition in China’s premium market segment, where both brands vie for the same high-end consumer base.

Samsung had an 11% decline in production to about 53.5 million units – at second place for the quarter. Its yearly production took an 11.3% hit, slipping to 229 million units and narrowing its lead over Apple to a mere 0.5%.

Xiaomi (including Xiaomi, Redmi, and POCO) slightly grew its Q4 production by 0.7%, reaching 43.1 million units and maintaining its third position despite a 6.1% annual decrease to 147 million units.

Oppo (including Oppo, Realme, and OnePlus) followed closely with a 3.4% quarterly increase, rounding off the year with a 4.1% dip to 139 million units.

Vivo (including Vivo and iQoo) managed a 4.1% growth in Q4, ending the year on a 2.9% decrease with 93.5 million units and sliding to sixth place in global production.

A standout performer, Transsion, (including TECNO, Infinix, and itel) not only achieved a robust 11.3% growth in Q4 but also made history by breaking the 90 million annual production barrier—marking a 46.3% YoY increase and propelling Transsion to the fifth spot globally