Q3 foundry revenue to rise 13%

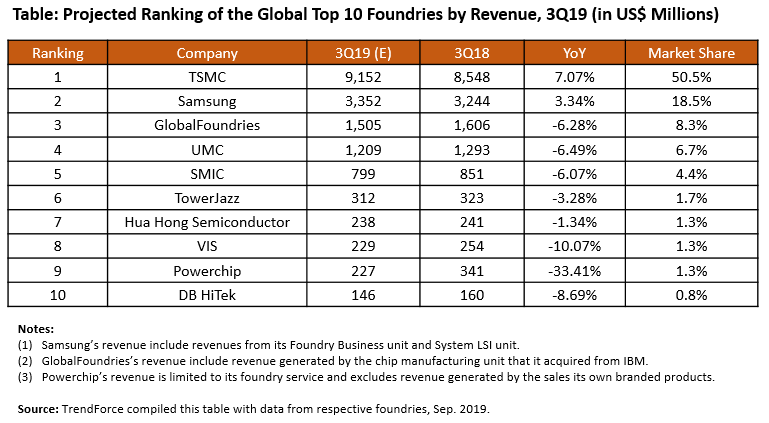

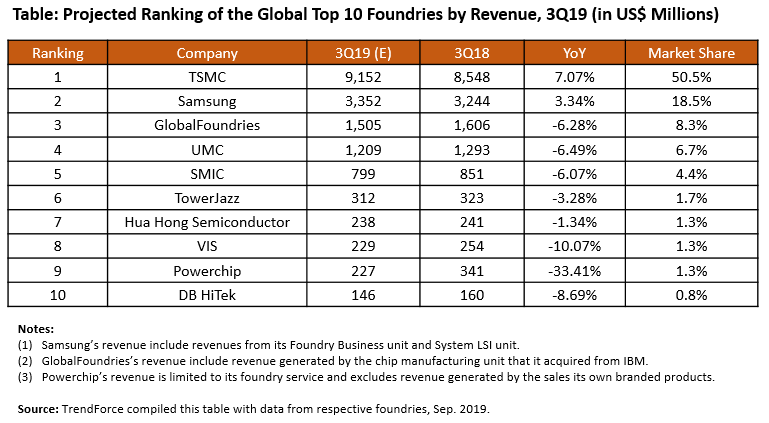

TSMC’s Q3 revenue market share is estimated at 50.5% and the market shares of Samsung and Global foundries are estimated at 18.5% and 8.3%.

End demand will be driven by the positive seasonality in 2H19, its growth will be lower compared with 2H18 due to the uncertainties around the US-China trade disputes.

TrendForce thus expects the rebound in the semiconductor market during the year’s second half to be significantly weaker compared with the same period of previous years.

TSMC has succeeded in leveraging its 7nm process to capture the demand from important customers such as Apple, HiSilicon, Qualcomm, and AMD. The capacity utilization rate of the 7nm process is now approaching 100%.

At the same time, TSMC is seeing returning demand for some of its legacy processes. Taking these factors into consideration, TSMC is forecasted to post a notable YoY growth of around 7% in its total foundry revenue for 3Q19.

Samsung’s foundry business is also expected to push back against market headwinds by tapping into its in-house demand.

Samsung has further segmented its process technologies in order to be more flexible in meeting different demands.

Additionally, Samsung has benefitted from the release of 5G smartphones. Samsung is using in-house chips for some of its 5G device offerings, while Huawei is using in-house chips for all of its 5G device offerings.

Samsung’s 10nm process is also mass producing Qualcomm’s 5G modem chip X50, which has been adopted by most other smartphone brands. Supported by the 5G demand, Samsung’s foundry revenue in 3Q19 is projected to grow by about 3.3% YoY.

GlobalFoundries has recently sold off several fabs along with its chip business to several buyers in exchange for capital and the commitment from the same buyers to continue placing wafer orders.

The company has also been able to use its RF SOI technology to increase the revenue from applications related to networking and communication solutions.

However, GlobalFoundries could see some reduction in revenue generation once the sales of its fabs are completed.

Another challenge to its operation is AMD’s decision to proactively develop 7nm product lines.

This, in turn, will erode the revenue from the foundry’s 12/14nm processes.

UMC was able to raise shipments and its capacity utilization in 2Q19 by taking advantage of demand related to application processors for low-end and mid-range smartphones, components for switches and routers, etc. UMC is expected to maintain revenue growth in 3Q19.

SMIC saw impressive revenue generation from its 55/65nm and 40/45nm processes in 2Q19 on account of a substantial flow of orders from the smartphone, IoT, and other related application markets.

The demand for its 28nm process also started to return during the same period. SMIC’s revenue is expected to continue on an upward trajectory in 3Q19. The foundry is currently developing its own 14nm process.

China’s growing demand and policy incentives could push domestic IC design firms like HiSilicon and UNISOC to allocate some of their production to SMIC’s 14nm process in the future if the yield rate for the technology is maintained at a high level.

Hua Hong Semiconductor’s revenue has gained on China’s demand for power discretes and PMICs. The company is expected to record a stable revenue growth in 3Q19.

VIS posted a stellar revenue result for 2Q19 owing to the influx of orders for PMICs. Its revenue generation reached the year’s peak in July.

Demand from the power semiconductor market is going to sustain VIS’s performance in 3Q19 and help the company to offset some of the revenue loss caused by the market shift to 12-inch wafers for display driver ICs.

TrendForce points out that the foundry market as a whole has been significantly impacted by the recent escalation of the US-China trade dispute. The raising of tariffs on both sides has affected a large swathe of the consumer electronics market, depressing the total annual demand for smartphones, notebook PCs, tablet computers, TVs, etc.

The impasse in trade negotiations between the two countries has also led to major Chinese OEMs being put on the US Entity List.

In the case of Huawei, the restriction on technology sales to the company is not expected to be lifted anytime soon; and the US government continues to add more of its subsidiaries and affiliates to the Entity List.

In light of these developments, foundries generally maintain a conservative view of the demand growth during the peak season of 2H19.