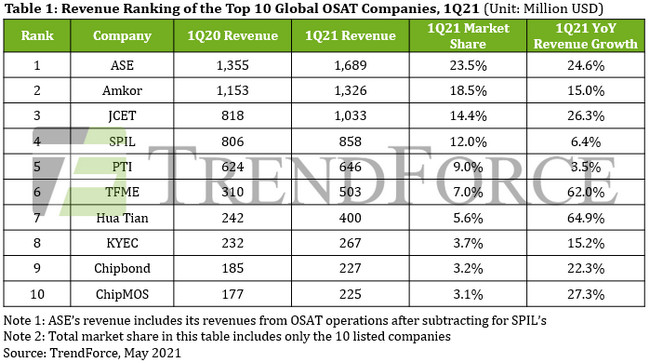

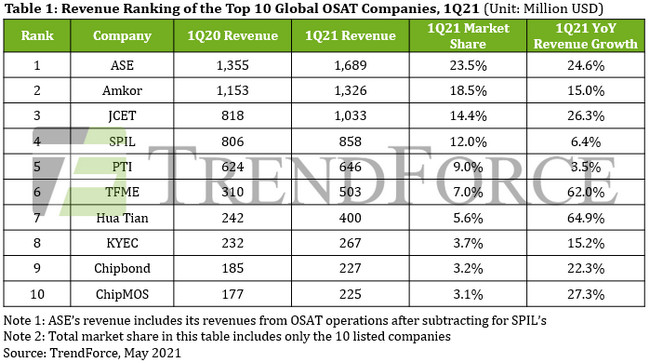

Q1 OSAT Revenues Grew 21.5%

Q1 revenues of the top ten packaging and test houses rose 21% y-o-y to $7.17 billion reports TrendForce, with most of the companies having double digit growth.

End-device manufacturers have been aggressively procuring components since 2H20, in turn leading to a tight production capacity for actors across the semiconductor supply chain.

Hence, OSAT (outsourced semiconductor assembly and test) companies gradually increased their prices in response to strong demand from clients.

TrendForce expects demand for end devices to be met ahead of time and potentially undergo a decline in 3Q21.

Clients in the end device markets are then expected to either slow their procurement activities or cut their chip orders, and revenues of OSAT companies may be negatively impacted as a result.

Industry leaders ASE and Amkor posted Q1 revenues of $1.69 billion and $1.33 billion, which are YoY increases of 24.6% and 15.0% respectively.

ASE gradually strengthened and increased the supply of its wire bonding services for chips used in notebook computers, telecom devices, and servers.

Amkor was primarily focused on developing its advanced packaging competencies.

SPIL and PTI recorded relatively slow revenue growths of 6.4% and 3.5% respectively to about $860 million and $650 million.

KYEC’s revenue for 1Q21 reached $270 million, a 15.2% increase YoY.

The three Chinese heavyweights JCET, TFME, and Hua Tian benefitted from the tensions between China and the US which led the Chinese government to focus on cultivating the domestic manufacturing of semiconductors which posed enormous demand for OSAT services.

As such, JCET and TFME grew their revenues by 26.3% YoY and 62.0% YoY to about $1.03 billion and $503 million, respectively, while Hua Tian also registered a revenue of $400 million for the quarter and delivered the highest growth among the top 10 at 64.9% YoY.

Chipbond, an OSAT company specializing in panel driver ICs, benefitted greatly from the surge in demand for large-sized panels (for TVs and IT products) and medium- and small-sized panels (for tablets and automotive displays), which generated high demand for COF (chip on film) packaging technology.

ChipMOS was able to capitalize on the recovering DRAM and NAND Flash demand.

Both Chipbond and ChipMOS posted a revenue of about $230, which is a 22.3% increase YoY for the former and a 27.3% increase YoY for the latter.