NAND And DRAM To Be Biggest IC Markets

NAND Flash and DRAM will remain the largest IC markets in 2020 accounting for a third of total IC sales this year, says IC Insights.

IC Insights'Mid-Year Update to The McClean Report 2020, ranks the 33 largest IC product categories based on their expected sales and unit shipment volumes.

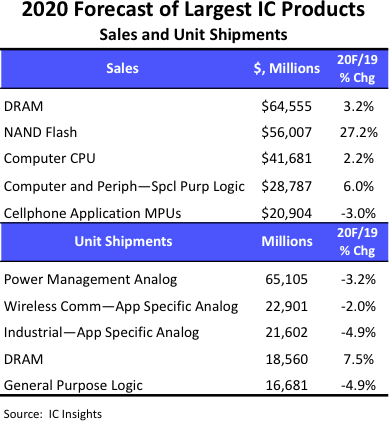

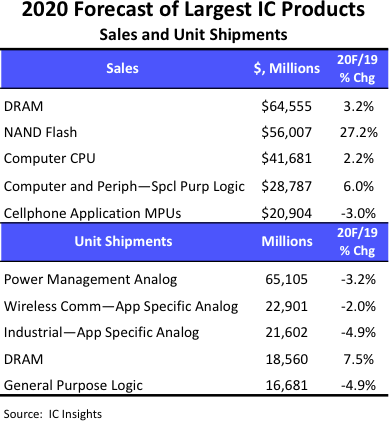

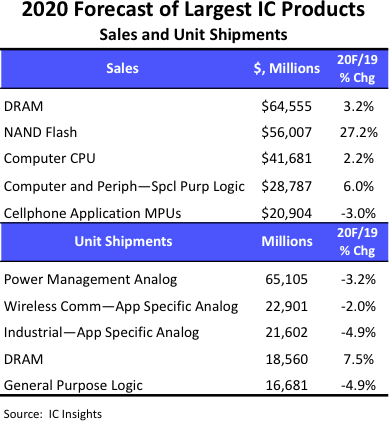

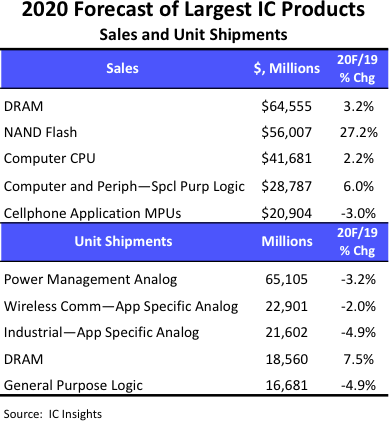

The five largest of these IC product segments in terms of sales volume and shipments are shown in Figure 1.

With expected sales growth of 3.2% this year, the DRAM market is forecast to reach nearly $64.6 billion, 15% greater than the NAND flash market, which is expected to be the second-largest IC segment in 2020.

IC Insights forecasts DRAM will account for 17.5% of the total $368.3 billion IC market in 2020 with O-S-D (Opto, Sensor, Discretes) sales adding another $104 billion to the total semiconductor market.

The DRAM market achieved its highest-ever sales volume in 2018 when it reached $99.4 billion. That year, DRAM sales accounted for 23.6% of the total IC market.

NAND flash is forecast to be the second-largest IC market in 2020 with sales of $56.0 billion, an increase of 27%—the strongest projected percentage growth rate among all 33 IC product categories this year. Like DRAM, the record-high year for NAND sales was 2018 when the market topped $59.4 billion. The NAND flash market is expected to represent 15.2% of the total IC market this year. Together with DRAM, the two memory categories are forecast to account for nearly one-third of all IC sales this year.

While overall microprocessor growth in 2020 is not as strong as expected at the start of this year, the large computer CPU market category is benefitting from increased Internet usage during the global Covid 19 virus health crisis.

Computer sales initially fell because of supply-chain constraints and other issues in China and Asia, but demand for personal computing systems and data-center servers grew in 2Q20 as more consumers, schools, and businesses increased their use of the Internet during the virus pandemic and lockdowns imposed by governments. Consequently, the forecast for computer CPU MPUs shows a 2.2% increase in sales to about $41.7 billion.

The coronavirus pandemic hit the cellular handset market hard in 1H20, but smartphones sales are expected to gradually improve in 2H20, especially with early users of fifth-generation (5G) handsets beginning to make purchases. Cellphone application processor sales are expected to decline 3.0% in 2020 to $20.9 billion, which still would make this segment the fifth-largest IC product category.

Three of the five largest categories for IC unit shipments in 2020 are expected to be analogue devices. Shipments of power management analogue devices are forecast to exceed the combined shipments of the next three-largest IC product categories again in 2020.

Each of the three analog categories shown on the list is forecast to experience a decline in unit shipments this year.

DRAM shows up as one of the largest categories for unit IC shipments in 2020. With an uptick in computer shipments to support increased online business, education, and e commerce activity due to the Covid-19 outbreak, DRAM units are forecast to rise 7.5% to nearly 18.6 billion units.