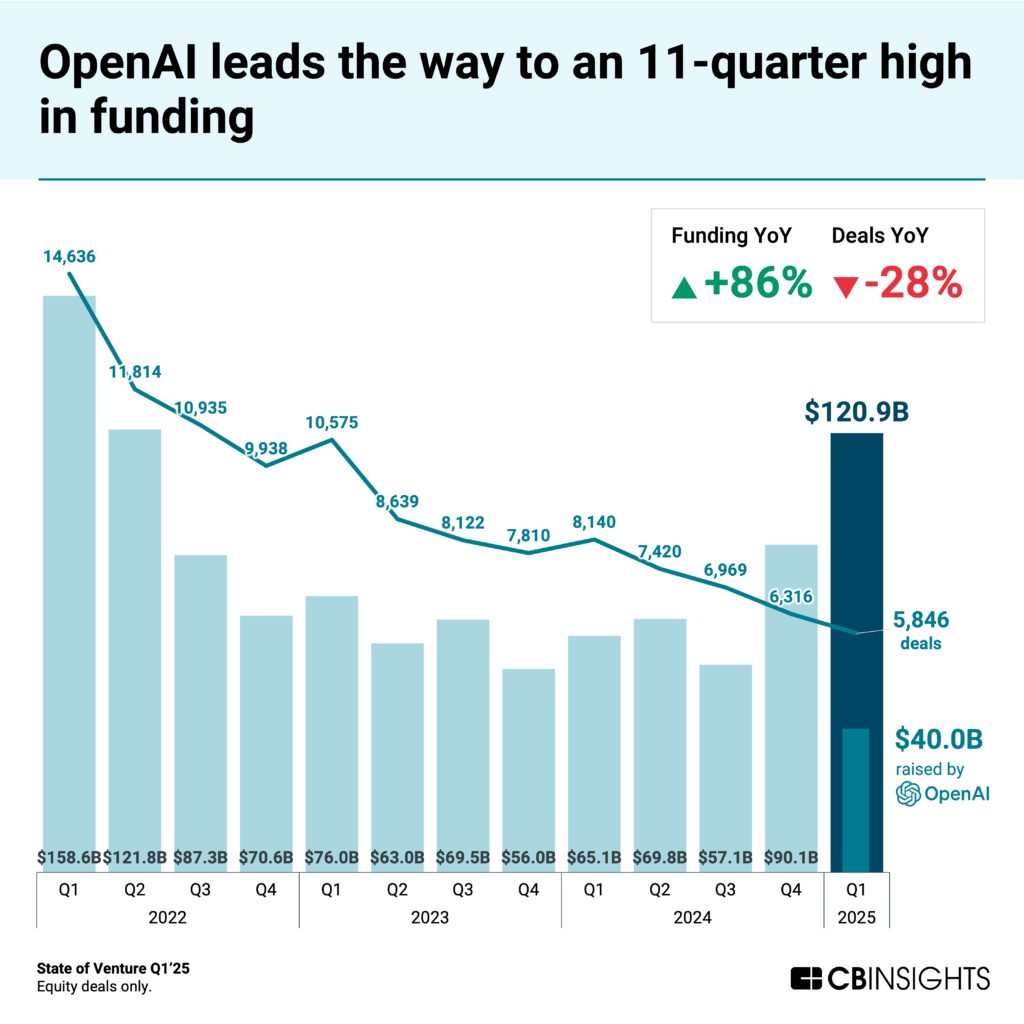

This ties OpenAI with ByteDance as the second-highest-valued private company globally (behind SpaceX at $350 billion.

The OpenAI funding round — led by SoftBank and backed by Microsoft, Thrive Capital, and others — marks the largest private funding round in history.

Even excluding this deal, total funding in Q1’25 would have reached $81B, still the second-highest quarterly figure since Q3’22.

However, global deal count slid for a fourth straight quarter, to 5,846 deals, down 7% QoQ and 28% YoY.

The stark contrast between soaring funding and declining deal count highlights growing capital concentration.

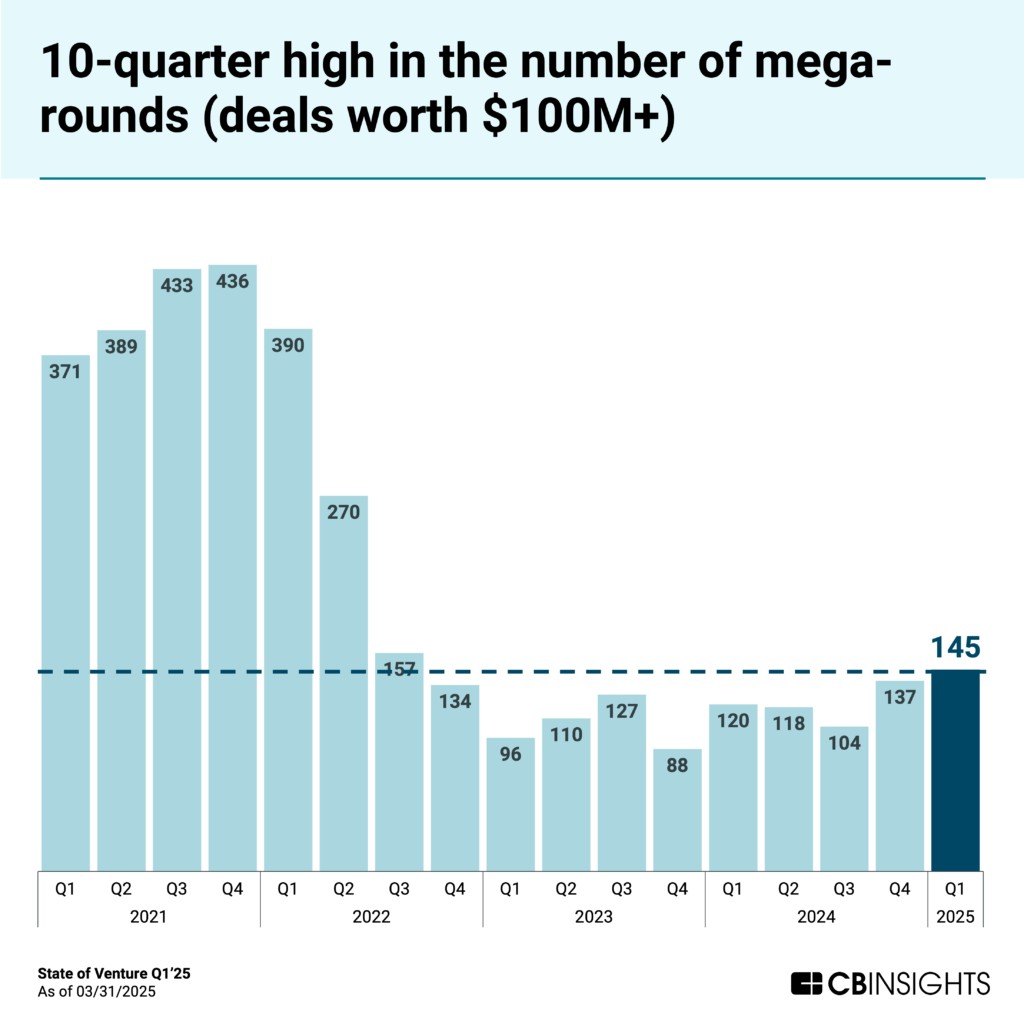

Mega-rounds (deals worth $100M+) accounted for 70% of all funding this quarter, up from 60% in Q4’24. A total of 145 mega-rounds closed in Q1’25 — the highest quarterly total since Q3’22, which saw 157.

While AI startups remain the primary beneficiaries of this capital concentration — grabbing more than half of the quarter’s funding — other sectors are showing resilience.

Fintech funding increased 18% quarter-over-quarter to $10.3B, retail tech rose 18% to $6.5B, and digital health grew 47% to $5.3B.

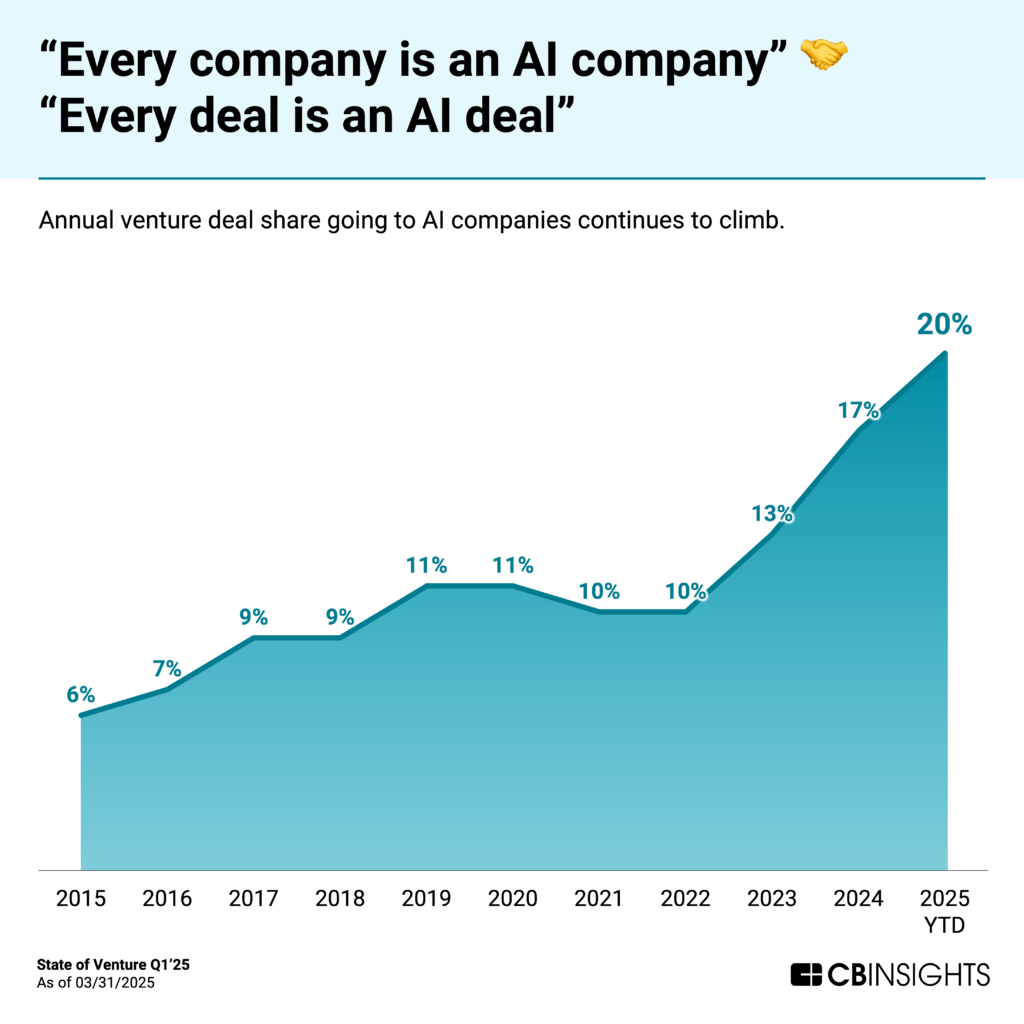

The influence of AI on venture capital continues to grow, with AI companies now capturing 20% of all venture deals globally — a new high, and up 2x since OpenAI’s launch of ChatGPT in 2022.

In absolute numbers, AI companies secured 1,134 deals in Q1’25 — a 7% decline from the previous quarter but still the fourth straight quarter with over 1,100 AI deals.

The composition of AI dealmaking is evolving. Early-stage deals (seed and Series A) made up 70% of all AI deals in Q1’25, down from 75% in full-year 2024. Correspondingly, late-stage deal share has increased from 6% to 9%, indicating market maturation as more AI companies progress to advanced funding stages.

The focus of AI dealmaking has also evolved. While infrastructure investments dominated the early AI boom, we’re now seeing greater emphasis on vertical solutions and application-layer platforms that address specific industry challenges.

Notable exceptions exist in emerging categories like voice AI, where infrastructure still attracts significant investment.

Geographically, US-based AI companies secured 52% of global AI deals in Q1’25, while Asia and Europe grabbed 21% a piece.

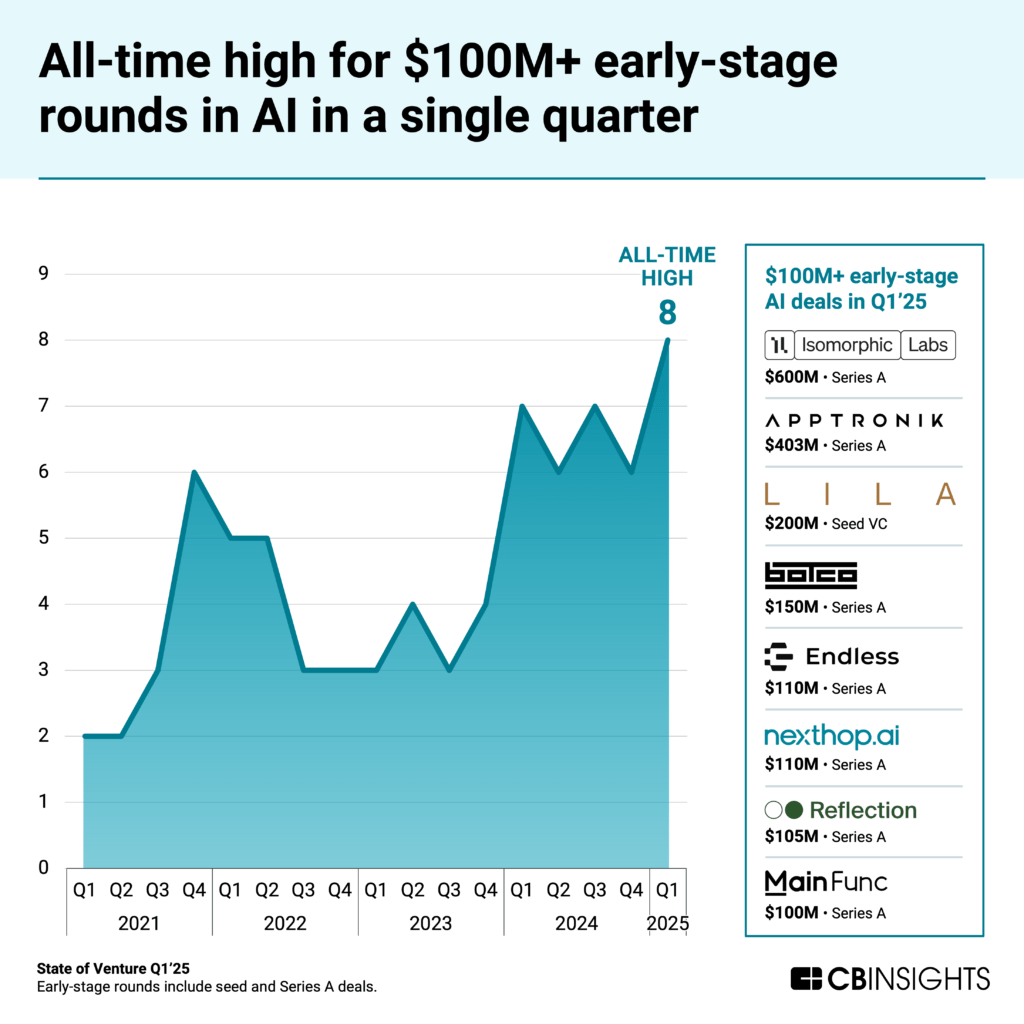

Q1’25 set a new record with 8 early-stage AI companies raising rounds of $100M or more. These 8 companies raised a combined $1.8B — with an average round size of $222M — highlighting investors’ willingness to place substantial bets on AI startups earlier than ever.

The companies represent a diverse range of AI applications:

Isomorphic Laboratories: $600M for AI drug discovery, spun out of DeepMind

Apptronik: $403M for humanoid robots

Lila Sciences: $200M for scientific research automation

The Bot Company: $150M for household robots

Endless: $110M for AI-led Web3 developer tools

Nexthop: $110M for cloud-native AI infrastructure

Reflection AI: $105M for coding AI agents

MainFunc: $100M for an agentic search engine

What unites these companies is their focus on specific industry or technical challenges — not general-purpose AI models.

This same trend appears among late-stage players that raised deals in Q1’25, with companies emphasizing enterprise applications, vertical use cases, and infrastructure optimization.

The shift from infrastructure to applications also plays out at the tech market level. Among the 1,400+ tech markets that CB Insights tracks, those in the below chart saw the greatest number of AI deals in Q1’25.

While LLM developers remain the top target for deals, they saw no growth in Q1’25 vs. Q1’24. On the other hand, vertical applications in industrials and healthcare — where AI is measurably improving automation — led in terms of YoY growth.