MCU Sales 2021

After falling 7% in 2019 because of a weak global economy and then dropping 2% in 2020 due to the Covid crisis, MCU sales rebounded with a 27% increase in 2021 to a record-high $20.2 billion, says IC Insights.

The 2021 surge was the highest percentage growth in MCUs since 2000. The average selling price (ASP) for MCUs climbed 12% in 2021—the highest annual increase since the mid-1990s.

Production-constrained MCU shipments grew just 13% in 2021 to 31.2 billion units.

The five biggest MCU suppliers accounted for 82% of 2021 sales.

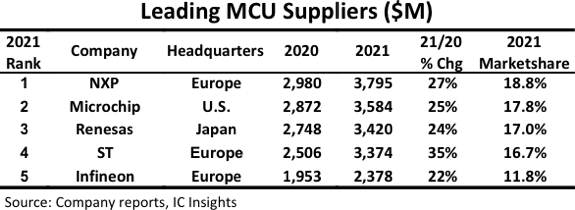

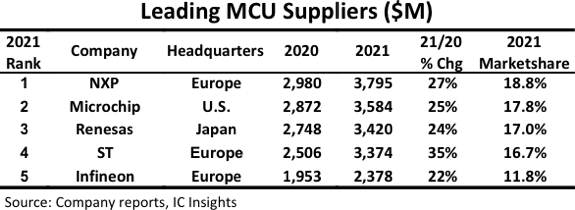

The sales rankings of the five largest MCU suppliers remained unchanged from 2020, according to IC Insights’ new second-quarter update of its 2022 McClean Report service (Figure 1).

The 2Q Update shows three of the 2021 top five MCU suppliers headquartered in Europe (NXP, STMicroelectronics, and Infineon), one in the U.S. (Microchip), and one in Japan (Renesas).

The five largest MCU suppliers develop and sell ARM-based MCUs. These companies accounted for 82.1% of worldwide MCU sales in 2021 compared to 72.2% in 2016—meaning the big keep getting bigger in microcontrollers.

The increase of the biggest MCU suppliers has resulted from major acquisitions and mergers since 2016.

The five biggest MCU suppliers are significantly larger than the rest of the top 10 in MCUs, according to the update report.

For instance, the second half of the top 10 (Texas Instruments, Nuvoton, Rohm, Samsung, and Toshiba) accounted for $2.3 billion in MCU sales last year, or 11.4% of the market total. Outside the top 10, MCU suppliers had just 6.5% marketshare in 2021.

In 2021, top-ranked NXP in the Netherlands slightly widened its MCU revenue lead over second-place Microchip by $103 million. Microchip increased its sales lead over third-ranked Renesas by about $40 million last year, according new estimates in IC Insights’ 2Q Update report.

Fourth-place STMicroelectronics saw the strongest sales increase in the MCU ranking with revenues rising 35% in 2021, which nearly lifted the company past Renesas—putting it just $46 million behind its Japanese rival.

Renesas had been the largest MCU supplier through the first half of the last decade but was passed in 2016 after NXP acquired U.S.-based Freescale at the end of 2015. Renesas’ marketshare in MCU sales stood at 17.0% in 2021 compared to 33.1% in 2011.

Germany’s Infineon remained in fifth place in the 2021 microcontroller ranking with sales that increased 22% to $2.4 billion—about $996 million less than ST in MCUs last year. Infineon moved into the top five MCU ranking after acquiring U.S.-based Cypress Semiconductor in April 2020 for $9.3 billion to expand further in automotive microcontrollers, power management, and other embedded systems applications.